In today’s fast-paced financial world, consumers are seeking tools that offer both simplicity and efficiency. The Zilch Classic is meeting this demand by blending transparency, ease of use, and modern technology into a credit solution that fits seamlessly into daily life. Rather than relying on outdated models, it introduces features tailored for today’s economy and digital habits.

More than just a spending tool, the Zilch Classic is a stepping stone toward financial independence. It eliminates hidden fees, confusing terms, and excessive interest, allowing users to plan ahead with confidence. As people continue shifting away from traditional banks, this card offers a fresh and empowering alternative for responsible credit usage.

What makes the Zilch Classic so appealing?

The appeal of the Zilch Classic goes beyond aesthetics or clever branding. It is rooted in its functionality and commitment to financial wellness. With the ability to pay in full or split payments interest-free, users gain greater control over their cash flow.

This card is designed to reduce financial stress, not add to it. Whether covering everyday groceries or funding larger purchases, users have the flexibility to adjust payments based on their current budget. It’s the type of freedom rarely seen in the credit card world—and it’s making a real impact.

How it reimagines the buy now, pay later model

The Buy Now, Pay Later (BNPL) model has exploded in popularity, but not all solutions are created equal. What sets the Zilch Classic apart is how it merges BNPL flexibility with the dependability of a credit card. Rather than juggling multiple platforms, users can pay in four interest-free installments or in full—directly from one account.

It also provides a consistent experience whether you’re shopping online or in-store. Through its app, users select their preferred payment method instantly, helping them stay in control without compromising convenience. This hybrid approach is especially helpful for consumers seeking predictable payments without surprises.

More than a payment tool

The Zilch Classic does more than let you choose how you pay. It rewards you for smart decisions. Users earn cashback on select purchases, unlock offers at major retailers, and enjoy benefits without needing to understand complex point systems. These rewards are straightforward and can be used to further reduce your balance or make new purchases.

There are no annual fees or surprise charges waiting in the fine print. By simplifying the financial side of shopping, the Zilch Classic builds trust while delivering real value. This is a card designed for long-term users who want credit to work in their favor—not against them.

Who should consider the Zilch Classic?

This card isn’t just for a niche market—it’s built for modern life. The Zilch Classic fits perfectly into the routines of people from all walks of life, whether you’re focused on saving, building credit, or simply managing your monthly budget with more precision.

From college students learning how to budget to full-time workers looking for hassle-free credit solutions, this card adapts to your lifestyle. It’s especially ideal for those who want the benefits of BNPL but prefer the familiarity and structure of a traditional credit card model.

Freelancers, gig workers, and variable earners

Those who don’t receive steady paychecks often struggle with rigid billing cycles. The Zilch Classic offers flexible options for people whose income may vary from month to month. Being able to break up payments during slower periods helps freelancers and gig workers maintain momentum without falling into debt.

Instead of punishing delayed payments with heavy interest, the card promotes adaptable plans and empowers users to make financial decisions based on their reality. That’s a rare feature in the credit world, where late fees and compounding interest are often used as traps.

Comparing Zilch Classic with traditional credit cards

Traditional credit cards often lure customers in with introductory rates, only to raise interest later. Many bury fees in fine print, leaving cardholders confused. Zilch Classic takes the opposite route, with a flat, easy-to-understand structure that promotes budgeting, not surprises. These shifts show what consumers truly value:

- No annual fees or interest if payments are made according to the plan.

- Real cashback rewards instead of convoluted point systems.

- Upfront transparency with payment breakdowns and schedules.

- Integration with digital tools that help track and plan spending.

The role of technology in user experience

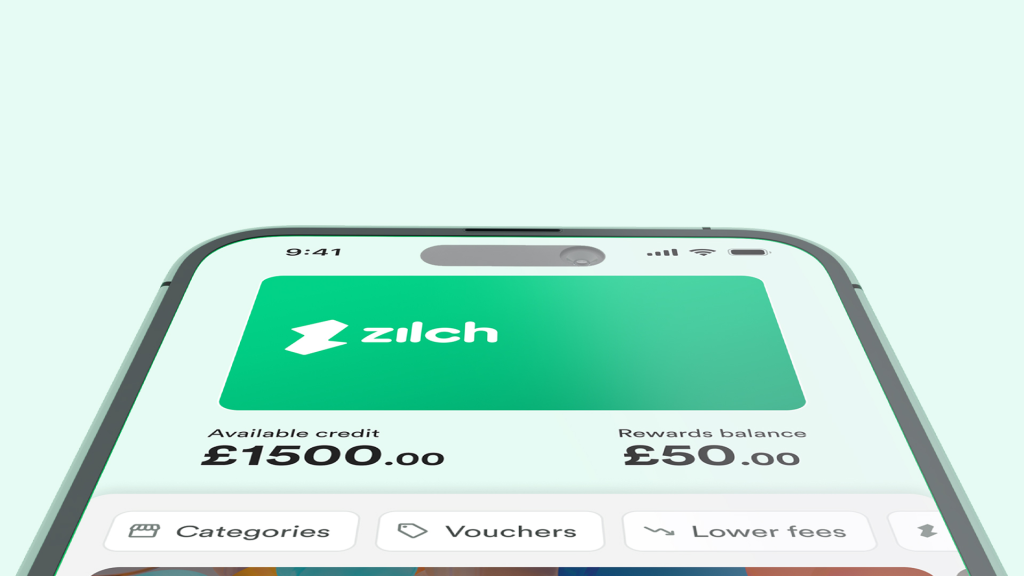

The Zilch Classic wouldn’t be as powerful without the technology that supports it. From app features to fraud protection, the card is built on a digital-first foundation. It’s a key reason why the user experience is so consistently smooth and intuitive across devices.

Everything from activating your card to choosing your repayment method can be done in seconds via the app. Notifications, spending summaries, and upcoming due dates are displayed clearly to help avoid missed payments. This kind of support builds financial confidence in real time.

Integrating with your digital life

Most users today rely heavily on mobile wallets and contactless payments. The Zilch Classic doesn’t disappoint—it’s compatible with Apple Pay, Google Pay, and other digital services. That means purchases can be made quickly and securely, whether you’re at a local shop or buying online.

Security is another major strength. With real-time alerts, biometric login, and encrypted transactions, your information is always protected. Knowing your data is safe adds yet another layer of comfort when using the card daily.

What real users are saying about Zilch Classic

User feedback is overwhelmingly positive, with many reporting better financial habits since making the switch. People mention the app’s intuitive design, the helpful reminders, and the peace of mind that comes from knowing exactly what they owe.

Some users have also credited the Zilch Classic with helping them build or rebuild credit thanks to its clear structure and manageable terms. It provides a second chance for those who’ve struggled with traditional credit options, offering a more forgiving and educational experience.

Community support and brand transparency

One of the unique aspects of the Zilch brand is its connection to its community. The company maintains open communication with users and regularly improves the app based on feedback. This feedback loop creates a dynamic relationship between the brand and its base.

Customer support is also accessible and responsive. Whether through live chat, email, or phone, help is always available. This approach contributes to the growing loyalty surrounding the Zilch Classic, and it makes a clear statement: this card was built for people—not profits.

Final thoughts: should you choose the Zilch Classic?

If you’re tired of credit cards that complicate your financial life, the Zilch Classic may be the upgrade you’ve been waiting for. With its clear benefits, interest-free structure, and strong technological backing, it redefines what responsible credit can look like in 2025.

More than just another card, it offers a new way to engage with your money. Every feature, from its flexible payments to real cashback, is designed to support your goals. It simplifies spending while encouraging good financial behavior—a rare and welcome combination.

You will be redirected to another website.